4 Easy Facts About Tulsa Bankruptcy Attorney Shown

4 Easy Facts About Tulsa Bankruptcy Attorney Shown

Blog Article

Affordable Bankruptcy Lawyer Tulsa Things To Know Before You Buy

Table of ContentsSee This Report about Tulsa Ok Bankruptcy AttorneyNot known Facts About Tulsa Bankruptcy Filing AssistanceA Biased View of Which Type Of Bankruptcy Should You FileThe Of Top Tulsa Bankruptcy Lawyers9 Easy Facts About Bankruptcy Attorney Near Me Tulsa Shown

The statistics for the various other major type, Chapter 13, are also worse for pro se filers. Suffice it to state, talk with an attorney or 2 near you who's experienced with bankruptcy law.Numerous attorneys also offer cost-free appointments or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is certainly the right selection for your circumstance and whether they believe you'll qualify.

Advertisement Now that you've determined insolvency is undoubtedly the best training course of action and you with any luck removed it with an attorney you'll require to obtain started on the paperwork. Prior to you dive into all the official insolvency kinds, you need to obtain your very own records in order.

How Chapter 7 - Bankruptcy Basics can Save You Time, Stress, and Money.

Later down the line, you'll in fact require to verify that by divulging all kind of details concerning your financial events. Below's a basic checklist of what you'll need on the roadway ahead: Determining files like your chauffeur's license and Social Protection card Tax obligation returns (up to the past four years) Proof of revenue (pay stubs, W-2s, freelance revenues, earnings from assets as well as any income from federal government advantages) Bank declarations and/or retired life account statements Evidence of value of your possessions, such as lorry and property valuation.

You'll desire to understand what kind of debt you're attempting to resolve.

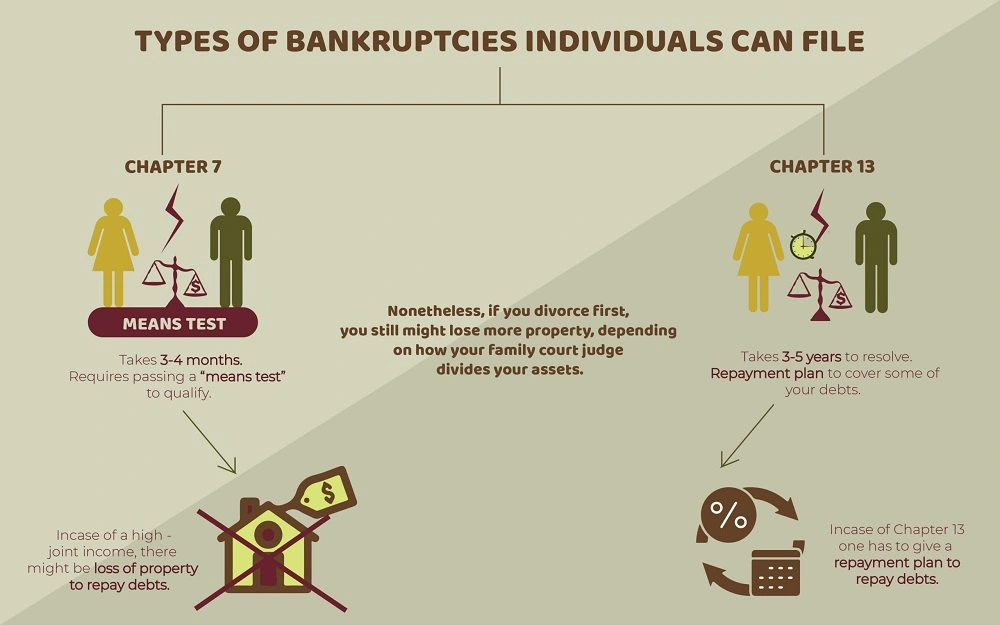

You'll desire to understand what kind of debt you're attempting to resolve.If your income is too expensive, you have an additional choice: Chapter 13. This option takes longer to fix your financial debts since it requires a long-lasting settlement plan generally three to 5 years prior to some of your continuing to be financial debts are wiped away. The declaring procedure is also a great deal more complicated than Phase 7.

The Definitive Guide to Tulsa Ok Bankruptcy Attorney

A Phase 7 insolvency remains on your credit rating report for 10 years, whereas a Chapter 13 personal bankruptcy falls off after 7. Prior to you submit your bankruptcy kinds, you have to first finish an obligatory program from a credit therapy agency that has been authorized by the Division of Justice (with the notable exception of filers in Alabama or North Carolina).

The training course can be completed online, face to face or over the phone. Training courses typically cost in between $15 and $50. You need to complete the course within 180 days of filing for bankruptcy (Tulsa bankruptcy lawyer). Make use of the Division of Justice's website to find a program. If you stay in Alabama or North Carolina, you have to choose and complete a course from a listing of individually authorized suppliers in your state.

Unknown Facts About Tulsa Bankruptcy Attorney

Inspect that you're filing with the correct one based on where you live. If your irreversible home has relocated within 180 days of loading, you ought to file in the district where you lived the higher portion of that 180-day duration.

Typically, your personal bankruptcy attorney will collaborate with the trustee, yet you may require to send the individual files such as pay stubs, tax returns, and checking account and bank card declarations straight. The trustee who was simply appointed to your situation will certainly soon establish a mandatory meeting with you, called the "341 conference" since it's a demand of Section 341 of the united state

You will certainly require to supply a timely checklist of what qualifies as an exception. Exemptions may put on non-luxury, key cars; required home products; and home equity (though these exceptions rules can differ extensively by state). Any type of building outside the listing of exceptions is thought about nonexempt, and if you don't offer any type of listing, after that all your home is taken into consideration nonexempt, i.e.

You will certainly require to supply a timely checklist of what qualifies as an exception. Exemptions may put on non-luxury, key cars; required home products; and home equity (though these exceptions rules can differ extensively by state). Any type of building outside the listing of exceptions is thought about nonexempt, and if you don't offer any type of listing, after that all your home is taken into consideration nonexempt, i.e.The trustee would not market your cars to instantly settle the creditor. Rather, you would pay your creditors that amount throughout your settlement strategy. A common misconception with insolvency is that when you submit, you can like this stop paying your financial debts. While bankruptcy can aid you erase much of your unsecured debts, such as past due medical bills or individual financings, you'll want to keep paying your month-to-month settlements for protected debts if you wish to keep the residential property.

Things about Bankruptcy Attorney Tulsa

If you go to threat of repossession and have actually exhausted all various other financial-relief alternatives, after that applying for Phase 13 might postpone the repossession and assist in saving your home. Eventually, you will still require the income to continue making future mortgage settlements, in addition to paying off any kind of late payments over the training course of your repayment plan.

The audit can postpone any kind of debt relief by several weeks. That you made it this far in Tulsa bankruptcy attorney the process is a respectable sign at the very least some of your financial obligations are qualified for discharge.

Report this page